What do you do if you go to your local pharmacy to fill your monthly insulin or other diabetes medication prescription, only to find that your health insurer has switched your medication without your doctor (or you!) knowing?

This practice is called ‘non-medical switching’ and happens when a health insurer removes a covered prescription from your health plan or moves it to a higher tier on your plan, making your co-payment prohibitively expensive. Plans will usually do this to save money.

The effects of non-medical switching can vary from a slight annoyance to extremely negative medical consequences.

In this post, I will explain why insurance companies sometimes switch your diabetes medication and the options you have for appealing the decision.

How do health insurance companies decide which drugs to cover?

According to Express Scripts, health insurance companies first look at the efficacy of a drug, not necessarily the cost of a drug, when deciding what to cover.

Health plans usually have committees made up of physicians and pharmacists who review the information that federal regulators used to approve a drug, in addition to how many other, similar drugs are on the market, before making a final decision.

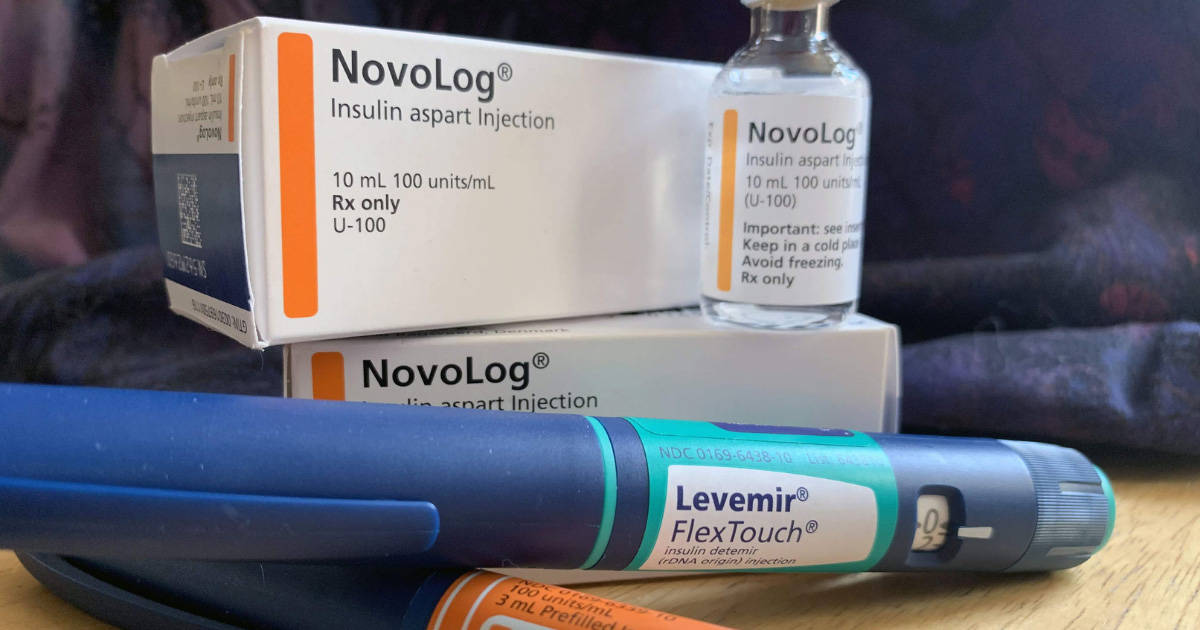

All health plans in the United States cover insulin, it just depends on what kind they’re willing to cover.

What is non-medical switching?

Non-medical switching is a common cost-saving tactic used by many health insurance plans in the United States.

It happens when an insurance company changes the terms of a contract or the cost of a medication for a stable patient; the “switch” isn’t due to medical reasons but is often a cheaper version that the health insurer has deemed interchangeable with the old medication that the patient was prescribed.

This practice differs from “step therapy” where a patient must “fail” on a drug first before the health plan will cover a more expensive one.

Think: forcing a patient with diabetes to use an older, human insulin (like R or NPH), and to eventually have a high A1c, before the health plan will cover a newer, faster, analog insulin, like Humalog or Novolog.

According to the U.S. Pain Foundation, non-medical switching costs the United States over $100 billion annually, and it directly hurts patients who are otherwise stable on their prescription medications.

Is non-medical switching always a problem?

It’s important to note that non-medical switching is not always a bad thing.

First, the practice is not very common, so if you’re newly diagnosed, don’t worry about this until it actually becomes a problem.

Second, if you’re taking a medication, but your health plan switches you to a newer version of the same drug that works even better, or a drug that works completely interchangeably with your old medication and you notice no difference, then there’s no problem and there’s no reason to worry.

Non-medical switching is an issue if your health plan changes your medication to another medication that you’re unable to take because your health will suffer if you do.

How to undo non-medical switching

Having your medication changed last minute, especially if you’re doing well on it, can be extremely frustrating. The good news is that you don’t have to accept these changes outright.

There are several things you can do to appeal a decision to switch your diabetes medication. Here is a step-by-step guide:

Call your doctor

The appeal process can take time, so immediately notifying your diabetes team of the changes you’ve experienced at the pharmacy counter is critical. Your doctor can offer advice on how to change your dosing amounts, if applicable.

If you’re unwilling or unable to use the newly prescribed medication, but your old medication is now exceedingly expensive, the American Diabetes Association and Beyond Type 1 have gathered a wealth of resources for patients who need help affording their medications.

Request your old medication

If you’ve been on a specific type of insulin or medication for several years or more (on the same health insurance plan), insurers typically won’t change your coverage, but it does happen.

If you’re unwilling to try the new drug, you should immediately call your health insurance plan and request your old medication.

The health plan may say that they need a prior authorization (PAR) from your doctor stating that the specific prescription drug they’re requesting is a medical necessity to you, and cannot be used interchangeably with another, cheaper drug.

A prior authorization request must be submitted through your medical professional – you cannot submit one on your own behalf.

Some people run into these issues multiple times a year, for multiple medications, as the PAR process is a way for insurers to cut costs (and avoid covering more expensive drugs for their clients).

Have your doctor request “99 months” on the prior authorization, so this headache does not become an annual event.

In a 2018 study in the Journal of Current Medical Research and Opinion, researchers surveyed 451 people with type 2 diabetes about their experiences with non-medical switching.

After their medications were switched, one in five had been told by their doctor that their blood glucose levels were somewhat or much worse than they had been on their previous medication.

About 20% also had to check their blood sugars more often than before they switched, which can become a physical, emotional, and financial burden.

Furthermore, nearly 1 in 4 said the non-medical switch negatively impacted their mental health.

Request a “peer-to-peer” review

If your health plan denies your request for your old medication back, you can request a peer-to-peer evaluation, in which your doctor confers with a doctor from the health plan to discuss why your specific medication is medically necessary.

This can sometimes solve the problem without going through a lengthy appeals process.

File an appeal (an internal review)

If you’re struggling with the new medication and you cannot afford your old medication (by paying the higher co-payments or paying out of pocket), your doctor can appeal your insurance company’s decision by requesting an internal review.

Keep in mind that this is a lengthy process and there is no guarantee of success. Here are the steps in filing an insurance appeal:

- Gather the denial letter from the previous attempts to get your old medication back. This is sometimes called a determination letter.

- Review your Explanation of Benefits document, to make sure the denial wasn’t made in error. You can always call your insurer’s customer service line to get more information about the original denial.

- Call your doctor’s office to let them know you’re requesting an appeal. They can help you with writing an appeal letter on your behalf, and even help you fill out the correct forms.

- Keep track of your blood glucose data for several weeks. Yes, we’re bringing out the old-school logbook (or a diabetes app). This can be used as evidence in your appeal that the new drug is causing negative consequences for your diabetes control.

Chris Plourde, who lives with type 1 diabetes and has experienced non-medical switching, says, “paperwork to substantiate your claim that the new medication isn’t a good fit is key. If you can provide documentation that the original drug worked, usually insurance companies will be okay with it,” she says.

“But you need a lot of documentation proving that you need it. If you get switched, write down your blood glucose readings, write down how the new medication makes you feel, write down all the changes you notice.”

File an external review

Sometimes internal reviews do not work out for the patient, and the insurance company sticks with its original decision. Don’t worry; you can request additional internal reviews, and even request an external review.

Conducting an external review means that you’ll bring in an unbiased third party who will decide the matter. Your health plan’s final denial letter will include information on how to file for an external review and the timeframe within which you must do so (usually 60 days from the final denial).

After a third party has made a decision in an external review, the health insurance plan is legally bound to accept it.

What are people doing about this?

Thankfully, many patient advocacy organizations are interested in solving this problem to prevent it from happening to more people. The Keep my Rx campaign is gathering grassroots support to spread awareness about this practice.

Additionally, many states are starting to ban non-medical switching or limit the practice.

In the last few years, California and Nevada have adopted such laws. States like Florida and Tennessee have also considered similar legislation, and Massachusetts has formed a commission to investigate the idea. Colorado has banned the practice for some drugs.

However you choose to get involved, your health and diabetes management should never be compromised for a health plan’s bottom dollar.